We provide both rapid results improvement services as well as transformation support services, whether in support of a merger integration or a business turnaround:

Inside Consulting Services Overview

- Outside Spend Reduction

- Zero-Based Budgeting

- Price Realization Optimization

- Net Revenue Retention Improvement

- Inventory Level Optimization

- CAPEX Spend Reduction

- Sourcing as a Service

- Zero-Based Budgeting

- Org Delayering

- Make/Buy Analysis

- Price Structure Improvement

- Sales Operations as a Service

- Cash Conversation Cycle Improvement

- Inventory Management as a Service

- CAPEX ZBB

- Footprint Rationalization

- Synergy Modeling and Capture (Labor, Vendor, Spend)

- PMO/Integration Management Office Support

- Synergy Modeling and Capture - Cross Sell/Upsell

- Sales Ops Synergy Tracking Support

- Cash Conversation Cycle Synergy Support

- CAPEX Sourcing Support

Rapid Results Improvement

We create rapid and sustainable step-changes in profitability and asset productivity- looking across both cost and revenue opportunities.

- Outside Spend Reduction: Strategic sourcing services with average spend compression of 20-25%. We can operate as an internal procurement team (Procurement as a Service) running sourcing events and conducting vendor negotiations on your behalf or as advisors/coaches- helping to upskill your team. Our results exceed those of typical sourcing consultants because we take a customized approach, using applied microeconomics and advanced techniques where required to optimize client leverage.

- Pricing optimization: Tailored price improvement initiatives, adding 2-5% points of Gross Margin, with minimal business risk. We systematically identify the best impact:effort opportunities- often from stemming revenue leaks and revising discount policies. Where needed, we support more fundamental changes, such as revising pricing structures or optimizing product/service bundling.

- Net Revenue Retention: Targeted initiatives for churn reduction, cross-sell / upsell improvement, often improving Net Revenue Retention Rates by 5-15%. Following a fact-based diagnostic we design actionable pilots to allow iterative testing and proof-of value. We work with your Sales Ops team and/or Chief Revenue Officer to test initiatives, measure results, and coordinate rollout across the sales organization.

Turnaround and Restructure Support Services

Turnaround situations are time sensitive and highly emotional. We provide rapid, fact-based diagnostics to clarify leadership courses of action and we’re capable of augmenting your leadership team to expedite progress.

- Our organizational productivity analysis is bottom-up and driver-based, not benchmark driven. This increases buy-in and helps avoid ‘overcutting’ functions arbitrarily.

- Our outside spend reduction experience lets us operate quickly, with minimal oversight required- helping leadership focus on strategic issues while delivering low risk earnings improvement.

- Our leadership backgrounds enable us to prioritize rigorously drive focus for the levers that matter.

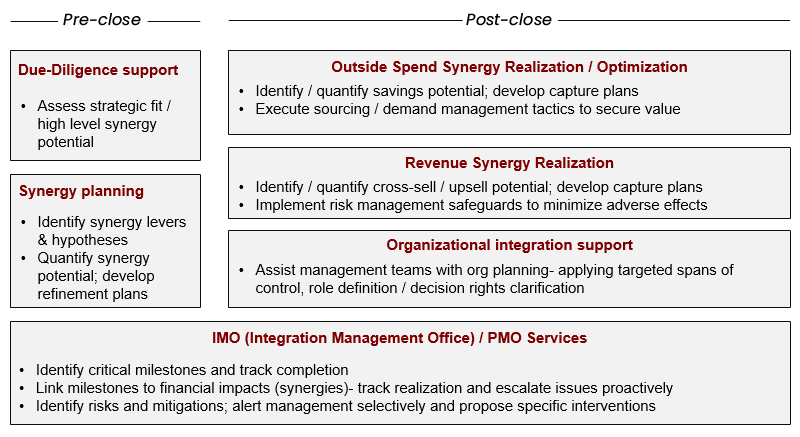

Mergers and acquisitions / Post Merger Integration

We can support screening and due diligence, as well as post-close value realization via synergy estimation and systematic capture.

- Our synergy target development is driver-based, bottom-up analysis enabling actual implementation and realization (as opposed to top-down benchmark driven figures which typically lack buy-in and go unrealized).

- Our ability to execute with minimal oversight frees up leadership to focus on the critical organizational and cultural integration tasks that create sustainable success.

We provide targeted support for merger/integration/re-structuring scenarios.

Private Equity Fund support

We support Private Equity funds across the portfolio company lifecycle: