Revenue Leakage & Sourcing Demand Management: Sides of the same coin

Many businesses leak revenue (undercharge customers) while also paying vendors for services not consumed. While these problems seem different, they’re aspects of the same core issue and offer significant low-risk profit improvement potential to proactive leadership teams. We explain why this happens and how to address the opportunity.

Would you be surprised to learn your business was leaking 2-3% of the total revenue it should collect? Or what if 5-10% of your vendor spend was completely wasted- going to services that are not being used? Is it possible that such low risk profit improvement opportunities exist?

Working with a variety of mid-market firms, we find precisely these sorts of opportunities all the time. The common issue here is the lack of systematic reconciliation analysis and subsequent “true-ups”. The question is why this tends to plague mid-market companies. We see two fundamental root causes at play:

- 1) Lack of Data / System integration obscures the issues and complicates reconciliations

- 2) Culture and incentives invite both revenue leakage and overbuying

Lack of Data / System integration: In a perfect world, a company’s systems are well-integrated and they deliver clear insight:

- Imagine customer quoting & contracting & product provisioning/usage & billing all being in-sync…Where this is the case, there’s no risk of underbilling a customer or providing services the customer didn’t request & won’t pay for.

- Imagine automated reconciliation between vendor spend and actual utilization of the good/service…In theory, you’d never pay for licenses / storage / features you didn’t use.

Technology vendors see this vision as well, and they’re developing and pitching new solutions to these issues all the time. Unfortunately, mid-market companies typically lack automated solutions to these challenges- whether due to affordability/capital constraints or insufficient scale to justify the investment. And even when companies invest in such solutions, in reality, the problem is complex and highly dynamic: the systems change, customers’ needs change, the company’s offerings and their pricing/bundling change. In our experience having good IT tools can help, but they’re not a solution to addressing these challenges– and proactive companies can address these challenges effectively even in the absence of robust automated solutions. The trick is to conduct targeted analytics and selective reconciliations to find leakage/excess volume and address it.

Culture and incentives: Think about the different groups involved – sales, operations, and their typical incentives.

The staff who manage product allocation / provisioning are typically risk-averse. They won’t shut things off unless it is clear that they should do so- after all, who wants to risk an upset customer? As a result, ‘zombie accounts’ can persist. Clone and backup systems consume power, software licenses, storage…Old equipment (long since removed) might still be receiving paid maintenance support– while other essential equipment might well be lacking maintenance coverage.

Sales, on the other hand, is typically motivated to make big promises. If you can upsell a customer, you do so. Not that it’s right, but on the margin, sales reps can over-promise. This can take the form of understating the amount of storage/compute needed, for example. (Though when operations corrects this later, who amends the contract and invoices?). This can take the form of not charging customers for change orders for overconsumption,

Often there is no incentive between sales, operations, and finance to conduct reconciliations. Who’s job is it to ensure invoices are accurate? To ensure upgrades in service levels / volume are captured in contract amendments and are invoiced? To ensure that when a customer departs the company decommissions their various services? To ensure that when pricing structures change legacy accounts get updated? Without a closed-loop process, there tend to be mismatches of ~2-5%. On the positive side, this means 95% of accounts are correct. But the 5% who are not represent avoidable profit leakage. Perhaps more importantly, an effective reconciliation process can also surface liabilities- where end customers are not receiving the services for which they are paying (think backup / disaster recovery / etc)- and the company can correct this before a crisis occurs.

Procurement should play a role, as well. Before sourcing something, they should evaluate exactly what the company buys- how much (why this amount? did we use this much? does this amount make sense, given the rate of customer account growth? Was there overage- and does this amount make sense, given the variability of demand?) and what price (was this priced correctly? were we charged for proper volume?). Unless someone addresses these fundamental questions, the organization might continue to overbuy. Or if someone catches a discrepancy, there could be very significant and low-risk profit improvement opportunity.

Consider an example: a healthcare technology company was looking to reduce its vendor spend. Careful analysis of a certain resold software package spend revealed that the company had been over-buying by almost 20%, based on review of end-customer usage and login records (the company continued to pay for instances dedicated to customers who had churned). Deeper analysis revealed that many existing accounts were not being charged correctly, due to multiple changes in the company’s product bundling and SKU pricing approaches- and that correcting the underbilling was worth ~96% of the annual cost of the software. The total profit impact of full reconciliation was over $300k- relative to $270k of annual spend on the resold software!

While these sorts of Revenue Leakage/Demand Management profit improvement opportunities are more common in technology firms- where overprovisioning of a virtual “product” is not immediately obvious- they exist in services and manufacturing firms, as well.

How to address the opportunity:

First, invest in the right skillsets: you need analytical horsepower and creativity….and you need experience in seeing similar patterns, so one knows what to look for. Not all mid-market companies have this sort of talent available, so they can augment their teams with consultants. The challenge is finding people skilled at these sorts of hypothesis-driven searches. You’re trying to find the 2-5% exceptions to the rule, and to do this cost-effectively with limited data. This is not typical procurement / process work.

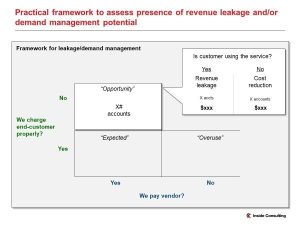

Next, perform a diagnostic: conduct targeted sampling of key accounts / vendors to understand the degree of potential, what fuels it- for which customer situations or product bundles do these issues seem more prevalent, and then extrapolate sample results to understand how much overall potential there might be and what type of action is warranted. The key here is minimal sufficiency: quickly rule out the ‘dry holes’ and spend more time in the richer veins. One example framework appears below- where categorize # of accounts and amount of spend in terms of product utilization and pricing accuracy.

Common framework for re-sold goods/services to identify discrepancies

Questions to consider:

- How certain are you that your company is not overbuying in various categories? Does someone know the precise utilization levels of your key resold SKU?

- How certain are you that you’re invoicing end-customers correctly? How certain are you that there is not ~5% revenue leakage?

- If your company lacks an automated reconciliation technology, when was the last time you audited customer invoice accuracy?

If the answers to any of these questions give you pause, feel free to contact us.