Protecting your margins during inflation: some practical considerations

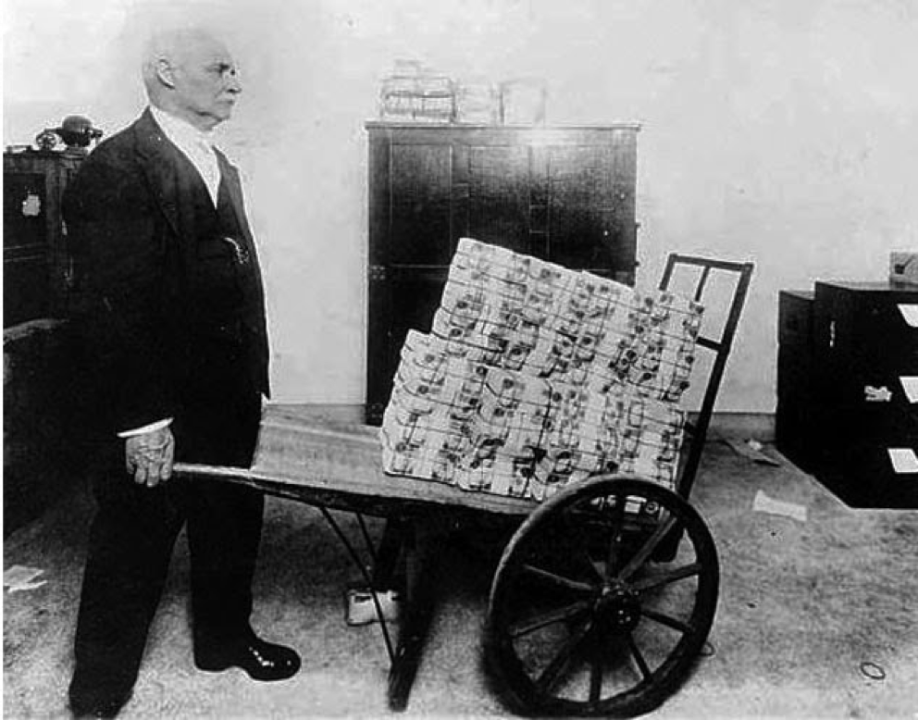

Chances are, you’re already acutely aware of the current inflation climate:

- Core CPI recently experienced the largest rate of increase since 1982

- As we re-open, demand is increasing across many categories yet capacity expansion lags, for a number of reasons, leading to surging price levels.

But as we all write ever bigger checks to our suppliers it’s worth considering what businesses can do right now to maintain, or even expand, margins. To that end, we’re offering a few practical observations from what we’re seeing in the marketplace, working with companies in both technology and manufacturing with their supply chain management and their pricing.

1) First and most obvious imperative: improve insight into your cost structure and identify justifiable cost recovery

At the risk of stating the obvious, business leaders should understand their cost structure intimately. How do costs scale with volume? How will vendor spend behave with changes in the business cycle? While this sounds simple, we find many mid-size firms are not necessarily well prepared, resulting in delayed actions and in less effective communications to their customer base.

This action is necessary but far from sufficient to preserve margins during an inflationary cycle.

2) Identify outliers and flaws of your current pricing model– and use this period as an opportunity to address them

Shifting focus from the cost side to the pricing model: how comfortable are you that your actual realized pricing (net of all volume rebates, trade discounts, sales incentives) correlates with account value? Might you be over-charging some very profitable and critical customers while excessively rewarding a set of small transactional accounts?

While most every business is enacting cost-recovery driven price increases right now, the best run companies are using this opportunity to also clean up sub-optimal pricing / discounting structures. Given that you’re already adjusting pricing and communicating to customers, bunding multiple adjustments into one visible move is more efficient and it reduces scrutiny and potential backlash.

Optimizing transaction-level price realization can yield margin improvement of 200-500 bp with minimal risk.

3) Reduce risk of supply shortfalls: evaluate the tradeoffs of unit cost versus risk and spend concentration versus fragmentation

During tight market cycles, ensuring product availability becomes a larger concern than that minimizing input costs. And this depends on having strong partnerships in place with key suppliers. In turn, this requires businesses to concentrate spend deliberately and to partner with suppliers effectively. Sounds easy- but for many reasons, mid-market companies can struggle with this.

Many businesses fragment supplier spend unintentionally. Buyers shop around and find opportunistic deals, to the approval of their bosses. Over time, however, this results in suppliers providing lower service levels (longer lead times, less value-added assistance, etc). Some businesses fragment volume intentionally as a way to reduce risk & diversify supply base.

This wisdom shifts during a tight market, though. The opportunistic buyers who previously touted unit cost savings now find themselves at the back of the line- struggling to obtain the critical inputs their business needs. Paradoxically, the desire to minimize risk (not put all your eggs in one basket) increases risk in a tight market as you suddenly find you just don’t matter very much to your suppliers.

What’s required here is to evaluate sourcing costs holistically: on a Total Cost of Ownership (TCO) basis to identify the value-maximizing approach: overemphasis on unit pricing and insufficient emphasis on other, less obvious but very real costs, can deliver a false economy. It is often the case that the simplistic ‘minimize unit pricing’ approach results in overall higher costs:

- Increased labor costs due to search (shopping time) and managing a much larger supplier base

- Inflated average inventory levels- due to slower lead times and perhaps to inconsistent ordering levels (as staff order more when they perceive a “good price”) versus consistent demand-driven ordering

- Higher average unit costs, relative to what could be obtained with greater volume commitment to a cost-advantaged partner.

It’s possible to reduce TCO costs while concentrating volumes with key partners- but partnership is no free lunch. Companies must learn how to be good partners, and this can involve new behaviors

- Concentrating volumes deliberately- shifting purchasing behaviors and centralizing previously decentralized decision-making.

- Sharing demand data- facilitating overall supply chain optimization

- Timely decision-making – letting suppliers plan their expansions / CAPEX

- Regular dialog that’s transparent, efficient, and fair (e.g., being honest about self-critique and not defaulting to blaming the supplier)

While many of these behaviors are subtle shifts, the most difficult is actually the mindset shift to partnership from adversarial zero-sum. This can be a tough transition for staff groomed in an adversarial approach. Yet the effort is worth it- as your access to key inputs might well hang in the balance of where your suppliers rate you as a partner.

Consider how sourcing works today in your company and whether your incentives motivate staff to consider the full cost implications adequately.

4) Consider alternative supplier contract structures – including index-based contracts where practical

Some mid-market companies attempt to time & beat their input markets… typically these firms have not considered the TCO implications of this approach. Such approaches incur ‘search costs’- which can be greater than you might think (labor, time, inventory). They yield inconsistent pricing (no one is consistently ‘below market’…quarter to quarter you might be ahead or behind) and they often yield higher average pricing (market timers are often wrong more than they’re right).

More importantly, this opportunistic practice diminishes the importance of the firm to its supplier base. After all, who wants to serve such an account compared to a customer who buys more consistently?

There is a better way.

Consider using index based pricing: paying a negotiated adder on top of an agreed market index value. Such an approach, where possible:

- Dramatically reduces search costs and supplier complexity. It can facilitate volume concentration– you feel safer awarding greater share of volume to that supplier. In turn, the supplier can justify higher service levels.

- Helps ensure ongoing visibility into underlying cost structure (market indices etc) which in turn helps the company implement market trend based pricing surcharges. Though many sourcing teams are not fluent in the micro-economic trends of all the major supply categories…but as more spend shifts to index-based models, this shifts.

- Improves working capital during cyclical upturns: pricing based on indices has a lag- so company pays advantageous price during periods of inflation (offset later by pricing which falls more slowly than the market).

————————————————————————————————————

All in all, by applying these concepts, a business can ‘cycle proof’ their margins. Margins need not compress during the market upturn or downturn. Well prepared sales teams can realize pricing opportunity quickly, with robust justification. Operations can mitigate the risk of supply shortfalls having invested in key supplier partnerships.