De-Risking Transformation: Why companies should address both revenue and sourcing levers

Very often, businesses executing transformations either pursue revenue initiatives or cost initiatives, but not both- leaving significant value on the table. We explore why this tends to happen and how it can be advantageous to address both revenue and cost levers.

Typical situation:

Consider a typical mid-market company: Management and ownership have a keen hunger for results, as always- and for rapid impact. This is even more true for those companies with higher debt leverage and/or with Private Equity owners. PE owners face a limited timeline with a high need for certainty of results.

So what tends to happen? Risk aversion & incrementalism in the name of focus: companies might not undertake all the profit improvement initiatives they could. They might focus on pricing or sales force effectiveness…but not cost reduction (a typical scenario for “growth” focused companies). Or if there is a push for cost optimization, there’s often no appetite to address revenue initiatives in parallel. While the desire to simply focus on a few, narrowly defined initiatives is understandable- it can leave money on the table.

Rationale to address both revenue and cost reduction levers in combination:

To understand when/why it might make sense to pursue both revenue and cost initiatives in combination, it’s worth stepping back and exploring the key risk/reward attributes of each type of initiative:

- Cost initiatives: Whether related to labor costs or non-labor (i.e., vendor) costs, these initiatives typically require internal change management, but they offer relatively quick and certain payback. When addressing vendor costs, firms prioritize the biggest opportunities first.

- Revenue initiatives: Whether related to pricing changes or new product/service bundles, revenue initiatives come with greater uncertainty regarding how customers will respond. Firms therefore take an iterative ‘test and learn’ approach, scaling up initiatives as their confidence grows.

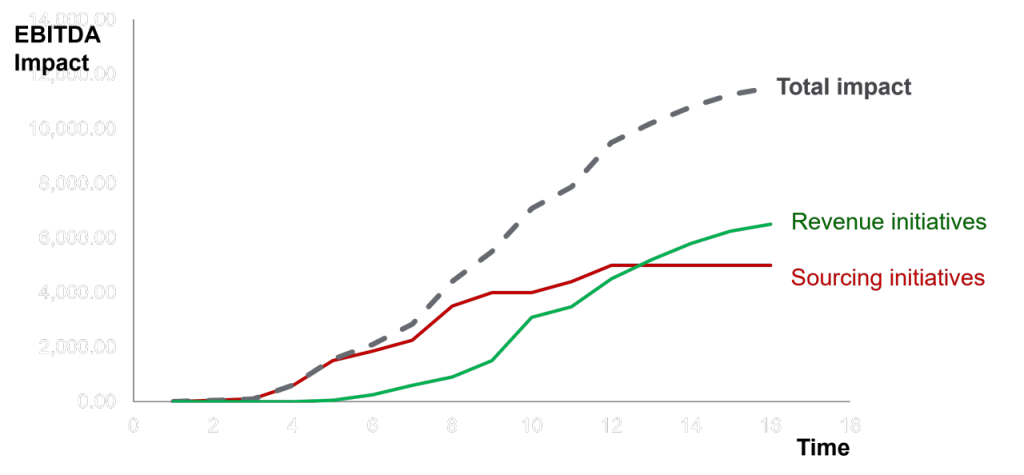

Each type of initiative has a characteristically different risk and payback profile:

Cost structure optimization is often necessary and can release critical cash for investment, but it rarely transforms a company’s trajectory. Accelerating revenue growth, however, can be transformative for a company’s business model and valuation.

Interestingly, if a company can pursue both types of initiatives in parallel, the combined effect is not only greater, but it also appears much smoother: (Sanitized data based on actual client engagement)

What’s happening here? Essentially the vendor spend reduction initiatives de-risked the revenue initiatives- delivering quick benefits which helped fund the overall transformation. The revenue initiatives, in the case of the above graphic– a mix of tactical repricing and revenue leakage reduction, new service bundling, and some more fundamental price structure changes– offer greater overall business impact. However, these revenue initiatives, given the degree of system change, salesforce change, and pace of customer response, would require a year to hit the inflection point and ~18 months to deliver full value. In the abstract, this seems like an obvious decision, just viewing the charts. In reality, the cashflow needs of the first ~8 months feel extremely acute.

Seem obvious? What’s the catch? We find two main reasons firms do not pursue both cost & revenue initiatives:

a) internal belief regarding the company’s capacity for change

b) insufficient consultant flexibility or internal difficulty managing multiple teams/consultants

a) In the first case, leaders might understandably err on the side of focus and choose to pursue only sourcing or revenue initiatives. But recognize, they’re making implicit assumptions about how much managerial effort would be required to oversee multiple initiatives. Perhaps these assumptions are valid for DIY approaches or for consulting firms with junior staff. But these assumptions might be overly conservative and might be leaving money on the table. Moreover, in an era of high inflation it pays to address both pricing and costs in parallel- as one of the practical challenges is preserving margins as one’s costs increase.

b) Regarding consultant flexibility, it’s typically true that consultants serving the mid-market focus on either sourcing or commercial levers, but not both. Sourcing and pricing are two sides of the same coin, if you think about it. There should be natural benefits to thinking about the same problem from different perspectives. But most consulting firm staff lack credibility in both arenas. Consequently, companies face the unpleasant prospect of having to retain and manage different consulting teams to address cost & revenue initiatives. And many mid-market management teams deem this simply too unwieldy.

To mid-market company leaders & owners: We encourage you to think broadly about the potential profit levers available to you. Don’t assume you can only pull a single lever. Don’t assume there are not skilled consultants flexible enough to deliver on multiple fronts. De-risk your transformation efforts and pursue both sourcing & revenue improvements.