Situation:

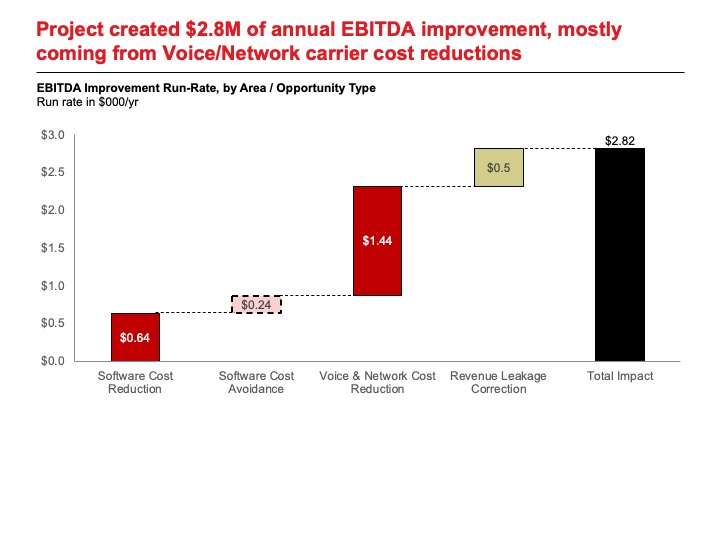

- Following a period of customer demand growth, the US market competition had intensified, pressuring price realization and margins.

- The company had addressed some vendors’ contracts but had not conducted comprehensive sourcing effort.

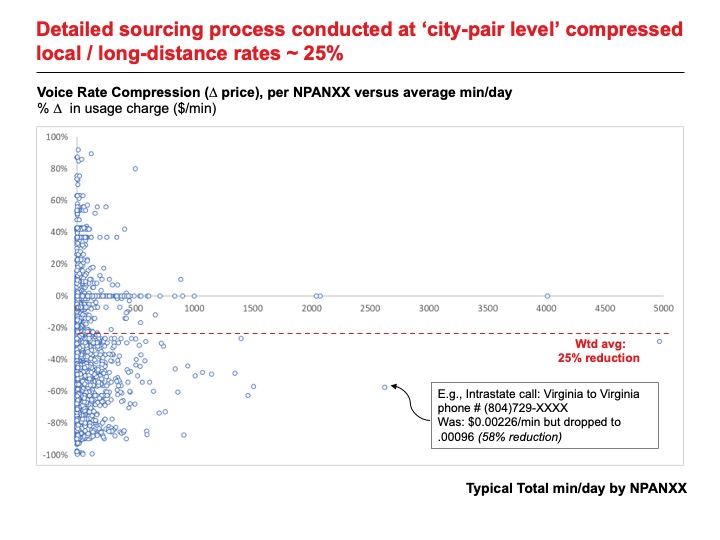

- Much of the company’s spend is in areas of telecom, where the sheer volume of circuits and connection rates (i.e., SKU proliferation) complicates competitive sourcing processes.